Home Sales Could Hit 30-Year Low in 2025 as High Mortgage Rates Persist

By: Jerry McMyne

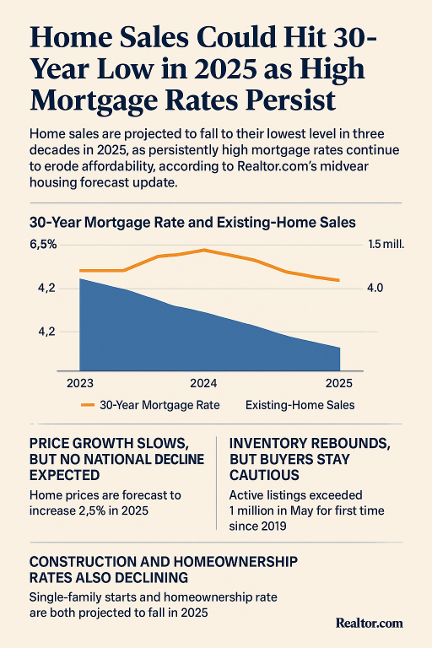

Home sales are projected to fall to their lowest level in three decades in 2025, as persistently high mortgage rates continue to erode affordability, according to Realtor.com®’s midyear housing forecast update.

Released Wednesday, the revised outlook from Realtor.com’s economic research team updates earlier projections made in December and reflects growing headwinds in both the resale and new home markets.

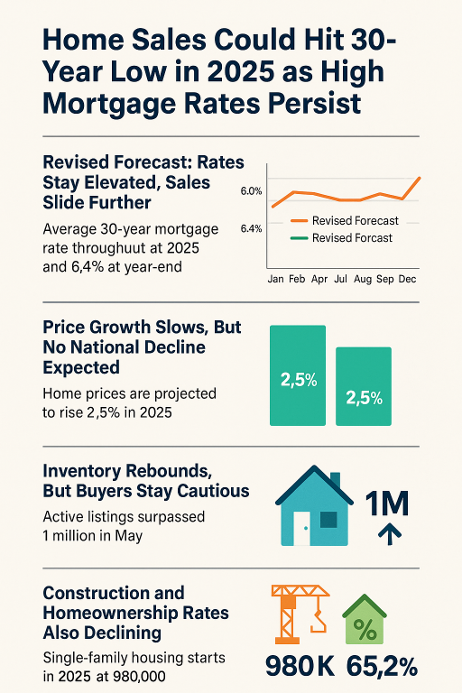

Revised Forecast: Rates Stay Elevated, Sales Slide Further

The forecast now expects the average 30-year mortgage rate to hover around 6.7% throughout 2025, ending the year at approximately 6.4%—both higher than initial projections of 6.3% and 6.2%, respectively.

As a result, existing-home sales are now expected to fall 1.5% year over year, dropping to just 4 million transactions. That would mark the weakest year for home sales since 1995, when sales totaled 3.8 million. The market had already reached similarly low levels in 2023 and 2024, according to the National Association of Realtors®.

“Even with more homes on the market, buyer response has remained muted compared to what we’d expect from similar supply shifts in the past,” said Danielle Hale, chief economist at Realtor.com. “In the South and West, inventory gains have been more pronounced, but affordability continues to hold back demand.”

In contrast, the Northeast and Midwest remain tighter markets, with steadier buyer activity but fewer homes available.

Mortgage Rates Tick Up, But Demand Remains Flat

Mortgage rates climbed last week to their highest level in a month, yet buyer activity remained largely unchanged. According to the Mortgage Bankers Association’s seasonally adjusted index, total mortgage application volume rose just 0.8% from the prior week.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances (up to $806,500) edged up to 6.84% from 6.82%. Points, including the origination fee, held steady at 0.62 for loans with a 20% down payment.

Price Growth Slows, But No National Decline Expected

Despite sluggish sales, the forecast does not predict a national price correction. Home prices are now expected to rise 2.5% in 2025—down from the earlier estimate of 3.7%. Many sellers appear to be opting out of the market rather than cutting prices, with delistings up 47% in May compared to the previous year.

Inventory Rebounds, But Buyers Stay Cautious

One notable shift in 2025 is a rebound in inventory. The number of active listings nationwide surpassed 1 million in May—the highest level since late 2019. However, the expected boost in sales has yet to materialize, with many prospective buyers sidelined by high borrowing costs and historically high home prices.

Mortgage rates have still been above 6.6% since January and recently averaged 6.75% for the week ending July 17, according to Freddie Mac.

Construction and Homeownership Rates Also Declining

The forecast also downgrades expectations for new home construction. Single-family housing starts are now projected to fall 3.7% in 2025, totaling just 980,000—well below the 13.8% increase forecasted in December.

With the nation still facing a multiyear housing shortfall, the ongoing lack of supply is contributing to a rise in the average age of first-time homebuyers, which has now reached a record 38. Many young adults continue to rent or live with family longer than in previous generations.

The homeownership rate is also expected to decline, falling to 65.2% in 2025 from 65.6% in 2024 and 65.9% in 2023.

Rental Market Remains Stable

There is some relief in the rental market. After a slight drop in 2024, median asking rents are expected to fall another 0.1% in 2025, offering some stability for tenants amid the broader housing slowdown.